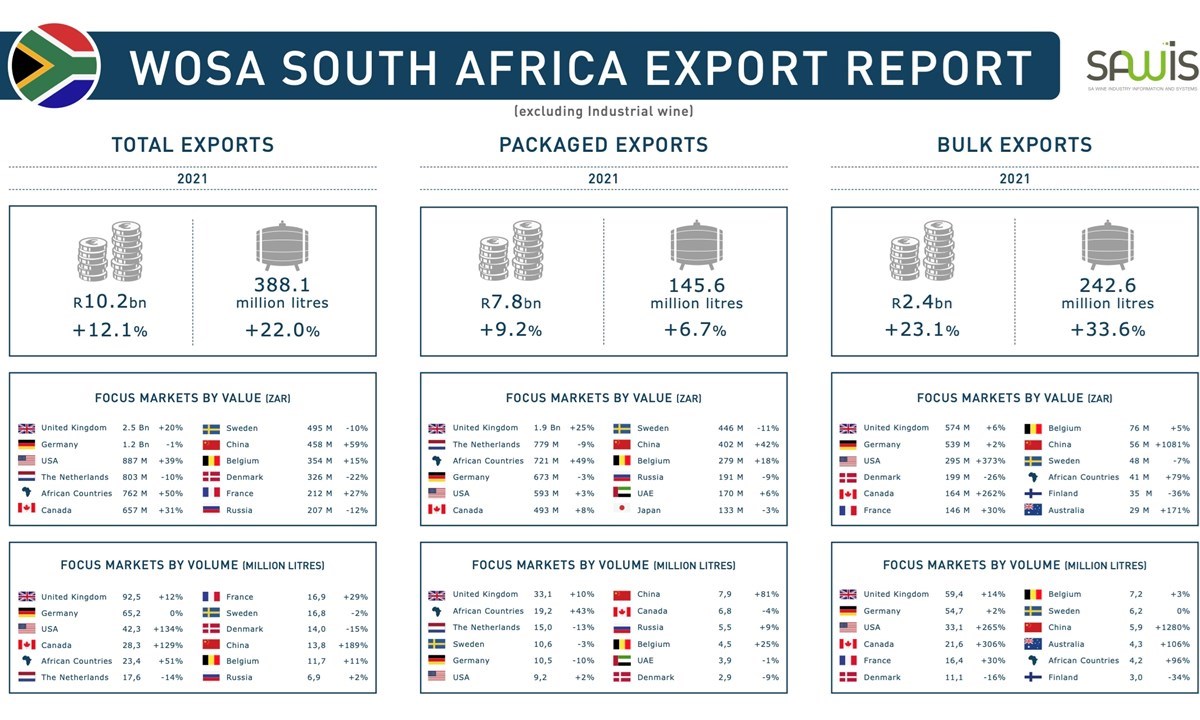

2021 will go down in the history books for many reasons, however for the South African wine industry, which was heavily impacted by a series of local alcohol sales bans, global freight and localized port issues, along with a shortage of glass and packaging materials, there was a distinct silver lining as export volumes recovered to a healthier volume of 388 million* liters, while the total value of our exports grew to R10,2 billion. This figure is most positive when compared to 2018 exports where a total volume of 420 million liters fetched only R9.1 billion.

The UK, South Africa’s largest wine export market showed good growth in both volume (+10%) and value (+25%) of packaged wine, which is very heartening, despite earlier fears about a negative impact brought on by Brexit and the Covid pandemic. This growth was mainly seen in the independent and specialist wine sector as well as in high-end multiple grocers. The UK market has been very supportive of South Africa’s wine industry during one of the toughest times it has ever faced and this can be seen in the growth of our exports.

China has been a buzzword within wine circles over the past year due to the Chinese trade war with Australia, and has presented increased opportunities for South African packaged and bulk wine due to the availability of quality wines which has allowed us to more than double our market share. For bulk wines, the opportunities for both the Chinese wine producers and brands being bottled in China, while with packaged wine exports, we have seen a large increase in listings of SA wines in major retailers with a number of national importers who have also expanded their portfolios to include South African wine.

African markets have also shown excellent recovery in 2021, with export volumes exceeding pre-Covid levels. Markets driving this growth are Nigeria, Kenya, Tanzania, Uganda, Mozambique and Zimbabwe. Further market insights show that this will continue in the future as the market expands.

The European focus markets of Germany, The Netherlands and Sweden remain largely stable, which is positive, despite harsh lockdown measures in all of these countries, which had a direct impact on trading conditions.

Both North American markets of Canada and the USA have shown volume growth. This has mainly been driven by bulk wine exports, however in these traditionally challenging markets and given the impact of the pandemic, this is considered to be positive on the whole. Gomberg-Fredrikson** data confirms the growth of South African wines in the USA; in fact, in 2021 South Africa was the only New World country to see positive numbers, with imports of packaged S.A. wine up 18% over the previous year.

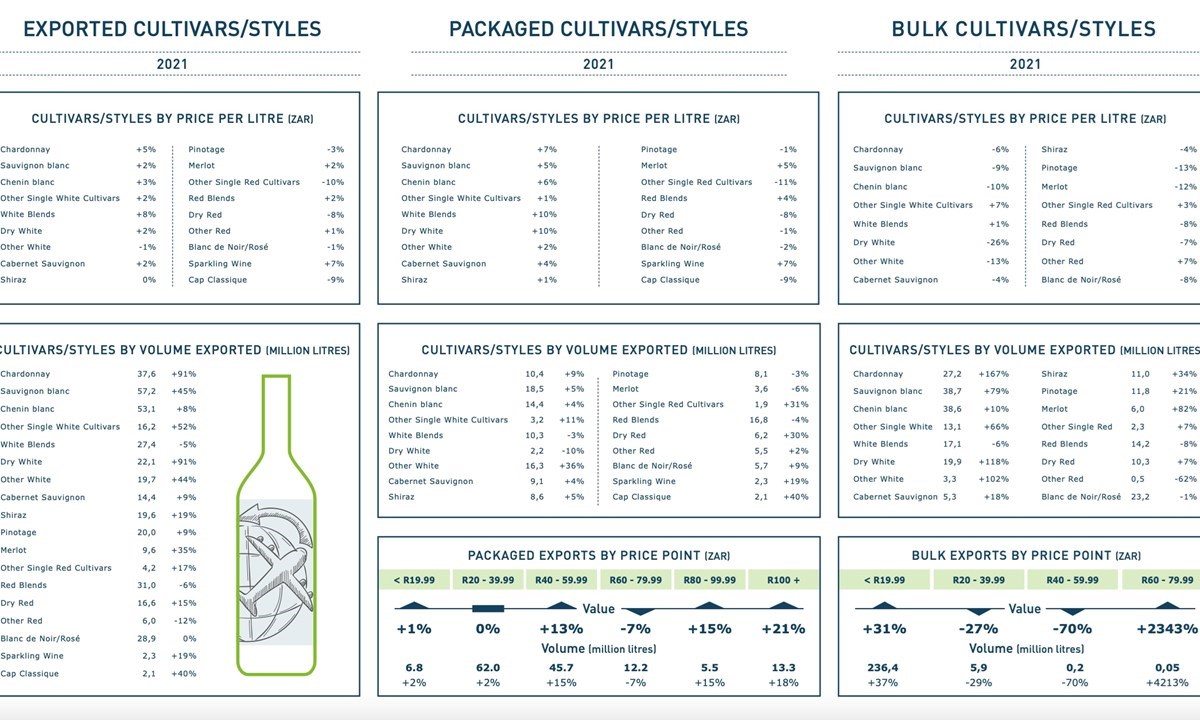

Packaged wine exports, which is pivotal in growing South African’s quality image, was impacted heavily by packaging supply issues, but ultimately managed to show good recovery and grew by 6.7% in volume and a pleasing 9.2% in value.

Bulk wine remains a significant factor in South African wine exports, however, in 2021 bulk exports played an imperative role in correcting the stock situation which was caused by a number of bans on local alcohol sales. The value of bulk wine exports (excluding industrial wine) increased by 33.6% in volume year-on-year. It is clear that white varieties dominated in 2021 with the year-on-year growth being driven particularly by the demand for Chardonnay (+167%) and Sauvignon Blanc (+79%). It is positive to note the long-term growth in Rand per litre of bulk wine, with an increase of 8% on total bulk exports and a pleasing 32% on still white wine between 2018 and 2021.

Traditional method sparkling wine, Cap Classique, has rocketed by 40% in volume in 2021 and is steadily gaining traction in this very competitive segment which is shared with Champagne, Prosecco and Cava.

WoSA CEO, Siobhan Thompson comments, “I am very heartened by the 2021 export figures. It is evident that our key markets see South Africa as a producer of consistently high-quality wine and that even under trying conditions we endeavour to keep supplying our markets and continue to sell wine responsibly, which further instills a sense of trust.”

She continues, “we look forward to welcoming trade and media from around the world to visit CapeWine from 5-7 October and will strengthen our position as leaders in sustainability practices through our theme, Sustainability 360.”

*Please note, this volume excludes industrial wine exports.

**Data for the period from January to October 2021.