Isaac Matshego, economist at Nedbank, at the Vinpro Information Day.

Presenters at the 17th Nedbank Vinpro Information Day themed Connect & Grow, held at the Cape Town International Convention Centre on 19 January 2023, were frank about the pressing economic and agricultural realities facing the wine industry at present, while encouraging participants to leverage their connections in order to mitigate the current reality. Close to 600 wine industry professionals attended the event, which was sponsored by Nedbank for the 16th consecutive year.

“It’s been three long years since the industry could connect in-person on this scale and if I learned one thing during this time, it is most certainly that there is no certainty in this world,” says Vinpro chairman Anton Smuts, highlighting the need for industry to take ownership of its own future.

Echoing Smuts’s sentiments, Nedbank’s executive head of commercial banking Herman de Kock reflects that nothing can be taken for granted – especially not the opportunity to connect with one another. “We believe that as a bank, it’s not just about the financial contribution – it is about the connection to the industry to help facilitate sector growth,” he says.

Navigating business in an unsettled economy

Nedbank economist Isaac Matshego painted a grim picture of South Africa’s post-pandemic economy, with falling investment and rapidly rising unemployment.

“We’re currently in the worst downturn in our history,” he said, explaining this downturn is “the longest and deepest, with the weakest start to the decade in recent history”.

A sustained recovery is difficult due to both global and especially local circumstances and will be further delayed as power outages persist. “It seems as though Stage 6 loadshedding will be the norm for 2023. We have seen this stage more than any other stage this year. This self-inflicted damage of loadshedding to the economy will mean that we may miss the boat of international investment expected from the 2024 global economic upturn.

“Investment remains weak on the back of low business confidence. On a positive note, however, compared to our emerging market peers, South Africa’s inflation rate did not shoot up that quickly and the Reserve Bank remains committed to managing inflation,” Matshego concludes.

Winning in wine

“It’s time to manage the storm we’re facing as an industry,” says Vinpro managing director, Rico Basson. “We’re hamstrung by political ideologies that are not outcome-based, have limited accountability, and no sense of urgency – this is at a time when our global competitors are far more aggressive in their execution.”

The past three years has brought crisis upon crisis. The wine industry needs to look at creating stability within the disruptions from the local and global trade because this hampers the future of South African wine. “We are going to continue losing our competitiveness if we don’t act now,” Basson says. “Premiumisation is key to recovering as an industry, given the huge cost pressure at winery level and the reality that the market will not be able to absorb all the additional costs. Increases at winery level will need to be a delicate balance.”

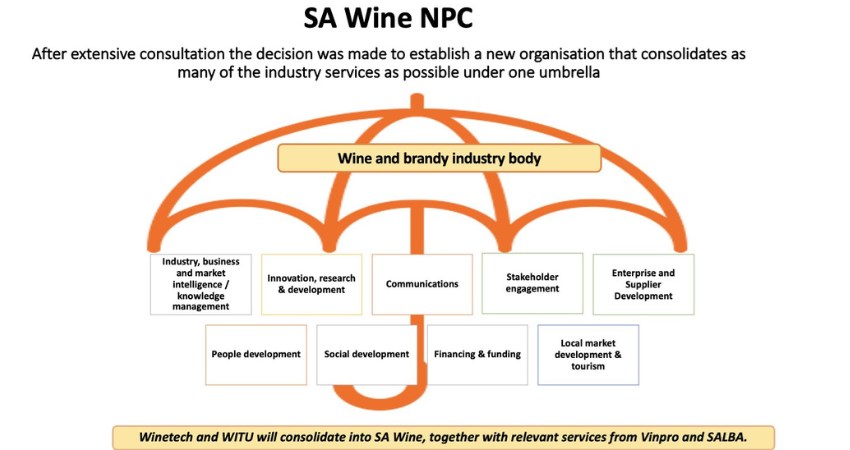

Following an industry strategy, funding and support services review process, Basson says the industry intends to change the narrative of South African wine by consolidating as many industry services as possible under a single umbrella, known as SA Wine NPC. Objectives of SA Wine include creating one voice for the industry with all activities coordinated around a singular industry strategy and one point of accountability for delivering on its overall strategy and needs.

An overview of the SA Wine NPC.

Smaller wine grape crop, multiple challenges

The 2023 harvest is expected to be significantly smaller than previous years with multiple factors contributing to it being the fourth lowest crop in the past 17 years.

“While there was sufficient irrigation post-harvest in 2022 despite lower dam levels, producers faced continued irrigation pressures with loadshedding,” says Vinpro consultation services manager Conrad Schutte. “Additional infrastructure costs for permanent and mobile diesel generators were also a hard reality many producers faced.”

Dry and warm conditions during the growing season added further pressure which was seen in the disruption of veraison and in sunburn damage. Hail damage in some regions and wind in others, coupled with an increase in mildew overall, added to the other pressures producers already face. Additional labour, as well as spraying and diesel costs to mitigate the above conditions, resulted in a very expensive season.

“The only positive to take out of the season is that we can and must connect our businesses with capable wine industry personnel as connected companies perform better.”

Creating fast results

Helen Kock of Vinimark paints a more positive picture of the local market for growth and innovation and recommends industry looks at creative and strategic ways to increase profitability for brands by creatively pulling feet into the wine category and growing the existing range.

She urges brands to optimise their relationships with local distributors. “Distributors can guide brands to know who and what they are, to better understand opportunities as they analyse the trade to properly execute sales plans.

“The reason brands fail is because of a lack of focus, accountability, simplicity, or transparency. Understanding what your brand’s focus is; who’s accountable for the work; how you’ll achieve simple brand goals and why your brand does what it does will lead to transparency and consistency over time and grow the wine category to have more brand leaders.”

Possibilities galore in the UK

Wines of South Africa (WoSA) chairperson, Siobhan Thompson, states the need to be focussed with limited resources, and to leverage the partnerships already built with key markets such as the UK to grow in value.

Emphasising value over volume growth, Thompson says that the progress of premiumisation of South African wine in the UK has created a good image of SA wines, even if we can’t always get our wines to the market.

“Be proud, but not complacent,” says David Cartwright from Seckford UK. “South African wine has shown drastic growth in volume and value in the UK during the past seven years. Dealing in trust and transparency, it’s important to know what is happening in the market and to share that knowledge with your clients. That is vital to the success of SA wine as a category.”

Following on Basson and Thompson’s sentiments for the premiumisation of South African wine, Cartwright paints an optimistic picture. “There is a huge amount of opportunity in the £10+ category for growth as it currently comprises only 1.7% of market share despite being the area of greatest growth for South Africa.”

Confident business investment in uncertain times

Michael Jordaan from Montegray ended the day on a positive note. “I remain enthusiastic about wine industry investments despite slow global economic growth and high inflation rates. I also believe it is important to work with entrepreneurs, because among all the depressing data lies opportunities, resilience, and ingenuity.

“Opportunities for innovation do exist,” he says. “Although our economic outlook is poor, South Africa is relatively resilient against inflation and thus still looks good to foreign investors. If recent years are anything to go by, the wine industry is buoyant and South Africa needs to continue to be marketed for its premium wines. Innovation is the way forward. Industry needs to pivot and double down on growth opportunities.”

Michael Jordaan, founder of Montegray, at the Vinpro Information Day.